Embedded finance has been growing in popularity in online commerce. There are several ways that this technology has made shopping through websites and apps more convenient, and businesses in almost every market have adopted it to some extent. It comes in many forms, but let's run down the basics.

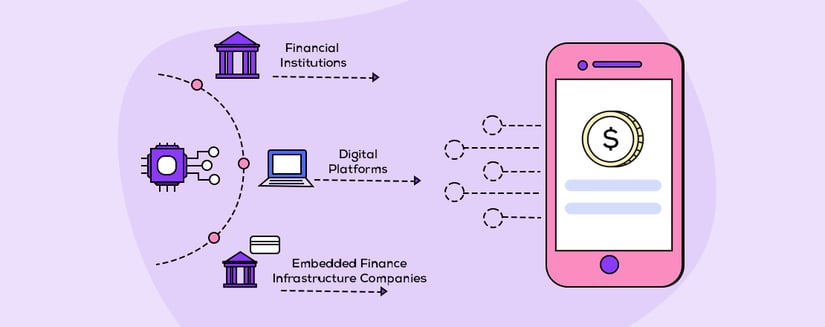

When referencing embedded finance, fintech companies are referring to the use of financial tools and services by non-financial companies. It is an umbrella term that covers many different tools and application programming interface (API) integrations that sales-driven businesses will add to their sites and apps to make the purchasing experience as seamless as possible.

There are a few popular forms of embedded finance, which are:

- Embedded payments

- Embedded insurance

- Embedded financing

Let’s dive into each, discuss some prominent examples of them, and the best options for one of the more common applications.

Embedded Payments

Payment processors were some of the first to offer embedded functionality to merchants. Embedded payments are the simplest form of embedded finance: Fintech firms and payment processors simply allow a website or app to integrate with their payment platform API.

This makes it so consumers can enter their payment information into the site or app, which will be sent to, and handled by, the payment processor. This form of embedded finance has become so common that it is almost standard, with nearly every ecommerce website having some form of payment API integration to ensure that their customers can pay in as many ways as possible.

These payment integrations can allow consumers to pay with credit cards, cryptocurrency, Paypal/online wallets, and even through consumer financing—more on that later.

Embedded Insurance

Tesla has made waves in the auto industry by bringing many elements of the finance and tech industries into it. One of these is embedded finance and the use of embedded insurance. Similar to embedded payment, Tesla’s embedded insurance functionality allows Tesla drivers to shop for insurance through their app.

Their API integration works with numerous insurance plans to give consumers several options at their fingertips. Since the Tesla app already has access to information about the car they drive, this streamlines the insurance process making it easier for customers to get insurance the moment they purchase their vehicle without having to leave the website or app.

Embedded Financing

Embedded financing is one of the newer developments on the list. Many ecommerce stores have adopted consumer financing options to help their customers with their bills, but financing can help more than just retailers. Auto repair shops, healthcare providers, contractors, and other high-cost services can also benefit from helping their clientele break their bills up into multiple easy payments.

There are a few different financing offers that are common among all of these industries:

- Installment payment plans

- Credit Cards

- Consumer loans

In order to offer these without pulling consumers off-site, merchants utilize API integrations yet again to connect their site with a fintech platform that can process credit applications and offer terms. The best platforms can provide multiple types of financing from numerous different lenders, giving a website the maximum level of flexibility.

This is similar to the embedded insurance concept, as it allows websites to display offers and accept applications for several different finance companies through a single API integration. More lenders means more lending criteria to check an application against, meaning that merchants can convert customers that may not have otherwise been able to qualify.

Implement Embedded Finance: Fintech’s New Tool With Skeps

Skeps offers a comprehensive, end-to-end consumer financing platform that helps businesses modernize their entire payment process. We go above and beyond one-click payment, also offering a one-click application process for several different types of consumer financing, including:

- Installment financing payment plans

- Store credit cards

- Consumer loans and leases

If you’re looking to partner with a forward-thinking fintech company that will keep consumers' eyes on the purchase while offering best-in-class financing, Skeps is the perfect fit.

Do you have more questions about how to adopt embedded finance: fintech’s next big thing?

Request a demo or contact us at support@skeps.com.