Enabling customer acquisitions, at scale

Skeps is the first microservices platform connecting bank quality financial solutions to consumers & small businesses directly within their buyer journey, in real time.

Skeps merges credit & commerce funnels into a single buyer journey

Double conversion rates while minimizing acquisition costs

Our comprehensive suite of financial product technology, implementation support, and tailored acquisition strategies are designed to meet the unique needs of consumer and small business cohorts.

Accelerate new product & partner launches

Augment your existing tech with the Skeps plug-and-play modules for speed to market

Lower cost of acquisition by 30%

Reduce wasted spend by reaching the most interested and qualified customers at the point of purchase

Remarket and engage to increase lifetime value

Post-acquisition, upsell and cross-sell additional financial products and services to new customers

Scale acquisition with a curated merchant network

Reach your design target across multiple industries as they consider purchase decisions

Configurable platform modules

Connect with Skeps once and get complete access to our suite of modules that accelerate your tech roadmap and data capabilities. Configure all or select the modules that add value to your business.

Digital Prescreen

Activate a mirrored version of your live decision model for real-time evaluation of credit eligibility – resulting in higher conversion and approval rates than legacy solutions. Skeps is the first platform to take the ‘pre-approved’ direct mail strategy and enable it across digital channels with a turnkey API solution. Uphold FTC and financial industry regulations, data security, and ensure rules management are all updated in real time.

Learn moreDigital Prescreen

Activate a mirrored version of your live decision model for real-time evaluation of credit eligibility – resulting in higher conversion and approval rates than legacy solutions. Skeps is the first platform to take the ‘pre-approved’ direct mail strategy and enable it across digital channels with a turnkey API solution. Uphold FTC and financial industry regulations, data security, and ensure rules management are all updated in real time.

Fraud and KYC/KYB

Skeps is connected to all the industry leading data provider solutions for fraud, KYC, and KYB. Our platform helps you easily generate and maintain self-serve workflows so you can create your own automated decision management and manual review processes – within your existing environment.

Learn moreFraud and KYC/KYB

Skeps is connected to all the industry leading data provider solutions for fraud, KYC, and KYB. Our platform helps you easily generate and maintain self-serve workflows so you can create your own automated decision management and manual review processes – within your existing environment.

Payments: Digital Card

Leverage the Skeps configurable out-of-the-box Digital Card platform to facilitate payments with save-to-digital-wallet and contactless payment capabilities. This technology enables a number of use cases such as self-serve branded gift card, employee recognition, and loan disbursement. Design programs with your brand in mind, or partner with merchants to support any number of their use cases.

Learn morePayments: Digital Card

Leverage the Skeps configurable out-of-the-box Digital Card platform to facilitate payments with save-to-digital-wallet and contactless payment capabilities. This technology enables a number of use cases such as self-serve branded gift card, employee recognition, and loan disbursement. Design programs with your brand in mind, or partner with merchants to support any number of their use cases.

A/B Testing

Skeps helps your acquisition and product teams easily gain insights for impacting growth. Our integrated features enable you to design, create and run champion challenger tests to optimize the end-to-end customer journey, including user experience elements and offer presentation.

Learn moreA/B Testing

Skeps helps your acquisition and product teams easily gain insights for impacting growth. Our integrated features enable you to design, create and run champion challenger tests to optimize the end-to-end customer journey, including user experience elements and offer presentation.

Consumer UX/UI & SKU Customization

Our platform enables speed-to-market deployment for the customer application journey through modular components pre-connected with leading credit and fraud third party data. Every piece has been vetted, approved and is in use with multiple banks today helping to ensure efficient compliance review.

Learn moreConsumer UX/UI & SKU Customization

Our platform enables speed-to-market deployment for the customer application journey through modular components pre-connected with leading credit and fraud third party data. Every piece has been vetted, approved and is in use with multiple banks today helping to ensure efficient compliance review.

Integrated Servicing Platform

You have complete flexibility to pick and chose modules in our integrated servicing platform, including operational resources to help support new product launches with an existing, experienced, operational team. Skeps has partnered with EXL to bring to the market an end-to-end loan servicing platform that covers all aspects of loan origination through loan management and support services.

Learn moreIntegrated Servicing Platform

You have complete flexibility to pick and chose modules in our integrated servicing platform, including operational resources to help support new product launches with an existing, experienced, operational team. Skeps has partnered with EXL to bring to the market an end-to-end loan servicing platform that covers all aspects of loan origination through loan management and support services.

Multi-lender

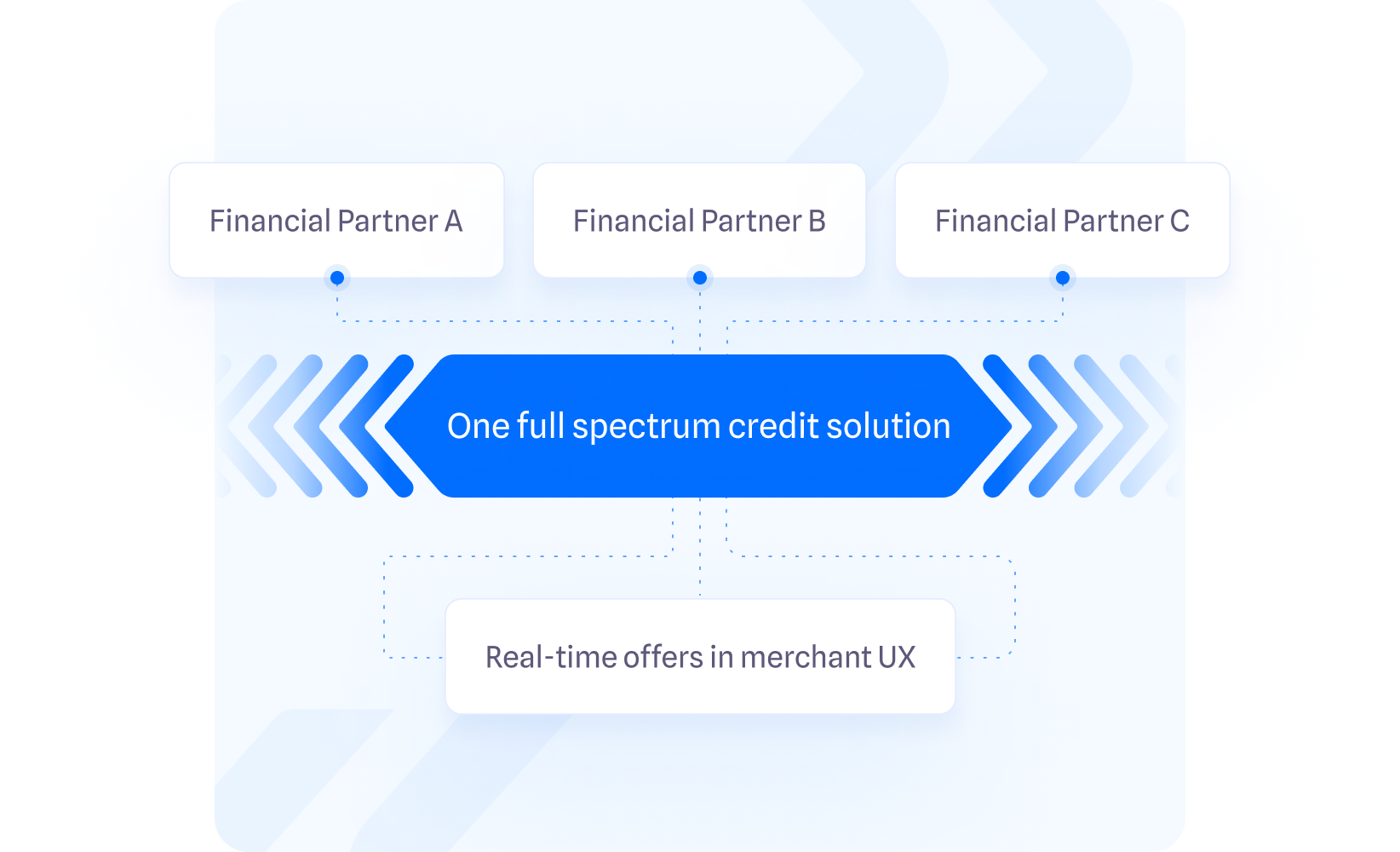

A next generation multi-lender platform with a single universal application and single credit pull – enabling a parallel-look versus the traditional waterfall approach to lending. Deliver a superior merchant partner experience to serve more customers. Engage with complementary lenders to deliver comprehensive solutions while maintaining your control over existing merchant partnership terms and preferences.

Learn moreMulti-lender

A next generation multi-lender platform with a single universal application and single credit pull – enabling a parallel-look versus the traditional waterfall approach to lending. Deliver a superior merchant partner experience to serve more customers. Engage with complementary lenders to deliver comprehensive solutions while maintaining your control over existing merchant partnership terms and preferences.

Loan Origination & Management System

Accelerate speed-to-market with turnkey Loan Origination System (LOS) and Loan Management System (LMS) to support new consumer and small business financial products launched with Skeps. Automate and streamline the entire loan life cycle including loan servicing, reporting, customer support, syndication and customer monitoring.

Learn moreLoan Origination & Management System

Accelerate speed-to-market with turnkey Loan Origination System (LOS) and Loan Management System (LMS) to support new consumer and small business financial products launched with Skeps. Automate and streamline the entire loan life cycle including loan servicing, reporting, customer support, syndication and customer monitoring.

Products supported on the Skeps platform

Our blockchain technology can enable most credit and financing products for our partners and we can explore additional product needs upon request.

Credit Cards

Small Business Loans

Installment Loans

Pay-Over-Time

On Card Installment

Expand distribution with the Skeps merchant network

Reach high quality consumers and small businesses in the moment they are actively seeking credit to transact online, in apps, or in person.

Multi-Industry

15K+ businesses across vertical sectors such as Home Renovation, Travel, Medical, and Retail.

High ticket transactions

Purpose built for larger basket size products and services over $500 and up to $100,000.

ROA accretive 2.5%

Across financial institution partners Skeps has consistently demonstrated profitability metrics.

Committed to exceptional customer experience and support

Skeps has partnered with EXL to for live call center support to ensure customers have 24/7 access to getting questions or concerns resolved.

Committed to responsible lending

Skeps works with institutions and financial partners that collectively serve a broad set of customer segments and are committed to regulatory compliance and customer service.

Orchestrate multi-lender partnerships to expand your value to top tier merchants

Design partnerships with complementary Financial Institutions in our network that are outside of the credit box for your current offerings. Unlock access to blue chip merchants with one unified application and parallel-look powered by Skeps. As a brand safe environment, only one financial partner will be revealed to the applicant after an offer has been accepted.