Point of sale lending offers a promising opportunity in this regard. By targeting buyers that have already arrived at the point of sale, lenders can pick up on leads that may not have considered financing otherwise. Not only that, but they are also virtually guaranteed to be actively considering a purchase.

What is Point-of-Sale Lending?

In a retail context, this creates an applicant pool largely composed of consumers that were ready to make a cash purchase but now may consider financing to either spread out the cost, or to make a bigger purchase than they originally planned to. While this is an exciting prospect in itself, there are also other industries where POS lending can actually bring in consumers that may not have converted otherwise, like:

- Healthcare and dentistry

- Home improvement

- Auto repair

- Big-ticket retail

How Do Consumers Use POS Lending?

Merchants and lenders that offer POS lending will have a simple one-click option both on their shop page and the checkout page to ensure that buyers understand that financing is available at every stage. All they must do is click the button, and they will open a quick application that will instantly tell them whether they are approved.

Once the cart has been finalized, the consumer will see the terms and payment breakdown of the financing they qualify for. At that point, all they must do is accept the terms, and the financing program will initiate upon checkout.

Why is POS Lending Important?

Offering financing at the point of sale is vital as it capitalizes on a customer at the highest point of interest. This allows lenders to get in on consumers who already want to buy from a merchant and for the merchants to capitalize on the increase in conversion and ticket size that comes with offering flexible payment options.

Who are the Main Players in Point of Sale Lending?

There are two different forms of POS lending providers dominating the market today: Alternative lenders that operate as both the software developer and the lender, and fintech companies that focus solely on creating the best possible software platform to connect lenders with merchants.

Alternative lenders include:

- Klarna

- Affirm

- PayPal

Fintech developers include:

- Skeps

- Jifiti

- Chargeafter

Banks and lenders looking to get into the POS financing space can use the latter category of firms. These firms focus solely on fintech, so they have exactly the expertise that banks will need to get involved, but they aren’t lenders themselves.

What Are the Benefits of Using a Third Party?

While lenders may be tempted to craft a POS lending platform in-house, developing a quality software tool can be extremely labor-intensive. In order to even get one off the ground, a firm would need:

- Software developers to build and maintain the tool.

- Web experts to work on integration with client websites and apps.

- POS lending experts to advise and craft offers.

- Months to develop, try, fail, and eventually deploy the product.

This may seem like par for the course when developing any product, but it is extremely costly in both time and money. Luckily, fintech third parties like Skeps have already developed the technology necessary to bridge the gap between lenders and their clients.

Skeps’ POS lending platform includes the following features out-of-the-box:

- Secure, real-time data and analytics through the blockchain.

- Versatile integration with virtually any website or app.

- Modules for all parts of loan origination from verification to settlement and servicing.

- Frequent maintenance and speedy bug fixes.

- White-label platform that allows the lender to put their own brand on the user interface.

Contracting with a quality third party like Skeps allows lenders to focus on handling the new business that comes from their POS lending offers. It also speeds up implementation, allowing lenders to deploy new offers within weeks.

Skeps’ process has been proven to increase approvals, minimize declines, and drive consistent growth for our clients. Not only that, but we make the onboarding process easy.

What Does Skeps Offer for Lenders?

Skeps offers the only true end-to-end consumer financing platform for lenders. Our software is completely omnichannel, meaning that it can be used on any website, app, or billing system. We also offer a one-click application for every type of consumer financing.

Skeps modular platform allows lenders to use us for modules they need while utilizing their own services for things such as servicing. This is what helps us get lenders in the market quickly.

All of this functionality comes in a white-label platform, meaning lenders can rebrand the Skeps software with their own name to ensure that all consumer rapport and brand awareness goes to them.

How Can Lenders Get Involved with POS Lending?

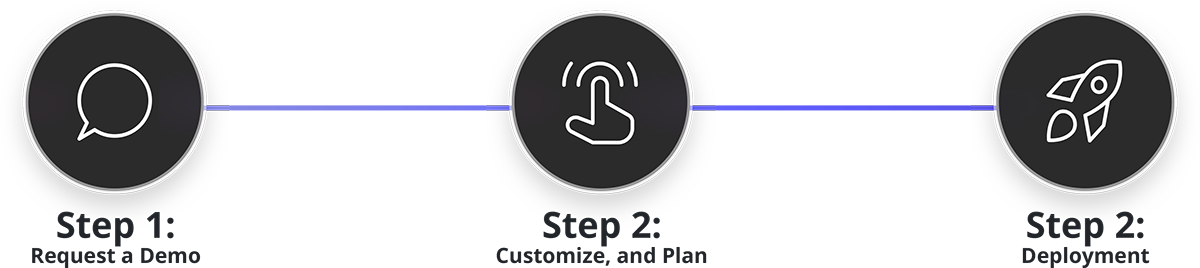

Getting started with point of sale financing is a simple process when done through an experienced third party like Skeps. The only thing that lenders need to worry about is identifying the markets they are looking to target.

Step 1: Request a Demo

Nobody would expect a lender to jump in blind, so Skeps’ offers an in-depth demonstration of what a POS lending product would look like for a client. Lenders can request a demo on the Skeps website and get an idea of what’s offered.

Step 2: Customize, and Plan

After the demo, lenders that move forward will work with the Skeps team to work out details like what markets they are looking to target, what channels they would like to appear in (online, in-store, email, etc.), and how to use our in-depth dashboard to control your program in real-time.

Step 3: Deployment

Once all of the details are worked out, lenders can deploy a white-label POS financing platform for themselves and their clients with their own brand name. They can also enjoy and adapt using Skeps’ in-depth analytics and rest easy knowing their data is secured in their own online environment.

Skeps’ Point of Sale Lending Platform

Skeps offers the only true end-to-end POS financing platform, and our cutting-edge software ensures that businesses get the most out of their financing program. We offer a simple one-click application for all types of financing and modules for servicing and collection to make us the only partner you will ever need to launch your lending program. Our unique technology allows lenders to make changes to their models in real-time while also providing an in-depth look at key metrics and analytics while also giving clients an in-depth look at key metrics and keeping costs low.

Do you have more questions about offering Point of sale lending? Request a demo or contact us at support@skeps.com.

What our partner lenders are saying

Skeps is a no-brainer for a easy and benficial POS System. Easy to integrate and predict oputcome without a head scratcher

Skeps is a no-brainer for a easy and benficial POS System. Easy to integrate and predict oputcome without a head scratcher

Skeps is a no-brainer for a easy and benficial POS System. Easy to integrate and predict oputcome without a head scratcher

Skeps is a no-brainer for a easy and benficial POS System. Easy to integrate and predict oputcome without a head scratcher

Skeps is a no-brainer for a easy and benficial POS System. Easy to integrate and predict oputcome without a head scratcher

Skeps is a no-brainer for a easy and benficial POS System. Easy to integrate and predict oputcome without a head scratcher

Skeps is a no-brainer for a easy and benficial POS System. Easy to integrate and predict oputcome without a head scratcher

Frequently Asked Questions

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.